Tax Services

We deliver innovative, integrated tax solutions, combining deep insights and expertise to help you navigate evolving tax laws and regulations, ensuring seamless global growth for your business.

Corporate Income Tax

As you grow, processes become increasingly complex, including taxation. We help your corporate tax function keep up with the constantly changing global tax environment so you can stay in compliance. Our experienced tax professionals have an in-depth understanding of taxation, and we help you see how your business processes integrate with the existing regulations.

Value Added Tax (VAT)

VAT affects your business on a daily basis since it is applied to transactions, which means compliance with VAT regulations is extremely necessary. We help you become compliant with the regulations, and we also help you maintain that compliance as you navigate through those ever-changing laws. We offer highly experienced advice to provide you with active solutions and proactive processes to prevent disputes, and we solve your existing VAT problems with our extensive and in-depth knowledge of how VAT works.

Transfer Pricing

Ensure compliance and fair pricing with our specialized transfer pricing services. We help you navigate the complexities of setting prices for goods, services, or intellectual property transactions within your multinational group, aligning with global standards and the arm’s length principle.

At Wathiq, we provide clear, compliant transfer pricing solutions that reflect what independent third parties would pay in similar situations. Our approach minimizes risk, supports regulatory alignment, and ensures that your intercompany transactions are fair, transparent, and well-documented.

Economic Substance Reporting

Ensuring the UAE Economic Substance Regulations (ESR) compliance has become an absolute necessity for the onshore and free zone companies in the UAE. Non-compliance with the ESR requirements would affect the operations of the company and it would cost the investors dearly. However, ensuring the ESR compliance at present is a tough task for companies as it is a fairly complex procedure. It is in this situation that the companies would require the assistance of a reputed UAE ESR compliance services provider like Wathiq.

Custom / Excise Tax

Excise tax, due to the nature of how subjectively it can be applied in different localities by different governments depending on which luxury products they want to be consumed less, can be very tricky to navigate, especially now when it is so easy and desirable for most businesses to go global. We help you manage your excise taxes so your services and goods can cross borders without hurdles, and you don’t suffer consumer dissatisfaction or face unprecedented losses.

Arslan Mushtaq

Partner - Tax

Arslan leads the team at our Tax division. His experience spans over 19 years of post-qualification tenure in VAT, Audit Assurance, and Internal Audit, working at PwC, KPMG, and FRHI in the UK and UAE. A pro-networker and badminton player, Arslan has served a large range of companies and groups of all sizes, ranging from multinational companies to family-owned businesses. He has acquired both firm and industry experience and served a number of clients in Financial Services, Media, F&B, Hospitality, Manufacturing, Real Estate, and Construction sectors. Clients reach out to Arslan to seek his expertise in UK & GCC Tax, Excise and Customs Duty, Zakat, as well as financial planning, budgeting, contract reviews, financial reporting, and development of policies and procedures.

Arshad Gadit

Partner & Global CEO

Arshad is our Global CEO, Head of Public Relations & Partner. He has over 2 decades of firm experience in Europe, South East Asia and Middle East. Prior to joining athGADLANG, Arshad has led the audit practice at BDO Bahrain as an Assurance and Business Advisory Partner. He has also been part of various Technical Committees and elected Technical Partner for Qatar, Oman and Bahrain Offices. He was associated Deloitte LLP UK and worked in the Banking Capital Market division of the firm. He is a highly motivated business leader with proven track record, technically astute, with the ability to grow the business and possesses sound financial services industry knowledge.

What We Think

The UAE’s Economic Zone Model: Lessons Learned and Best Practices

As a global business hub, the United Arab Emirates (UAE) has become a...

IFRS 15 – Rethink Transparency

May 2014, IASB issued converged IFRS 15 standard on the recognition of revenue...

Embracing Leadership: Empowering Women in Finance

Wow, the response to the ‘Women in Finance’ series has been nothing short...

Digital Transformation Importance for Businesses

The economic impacts of the Covid-19 pandemic are far-reaching and at a time...

Diversity and Inclusion – The Kindle of Breakthroughs and Innovation

Workplace diversity has hit the HR world like a storm. It is astonishing...

Cost Allocation: A Guide to Maximizing Efficiency and Minimizing Tax Liability

Shared service costs refer to the expenses incurred by a company for services...

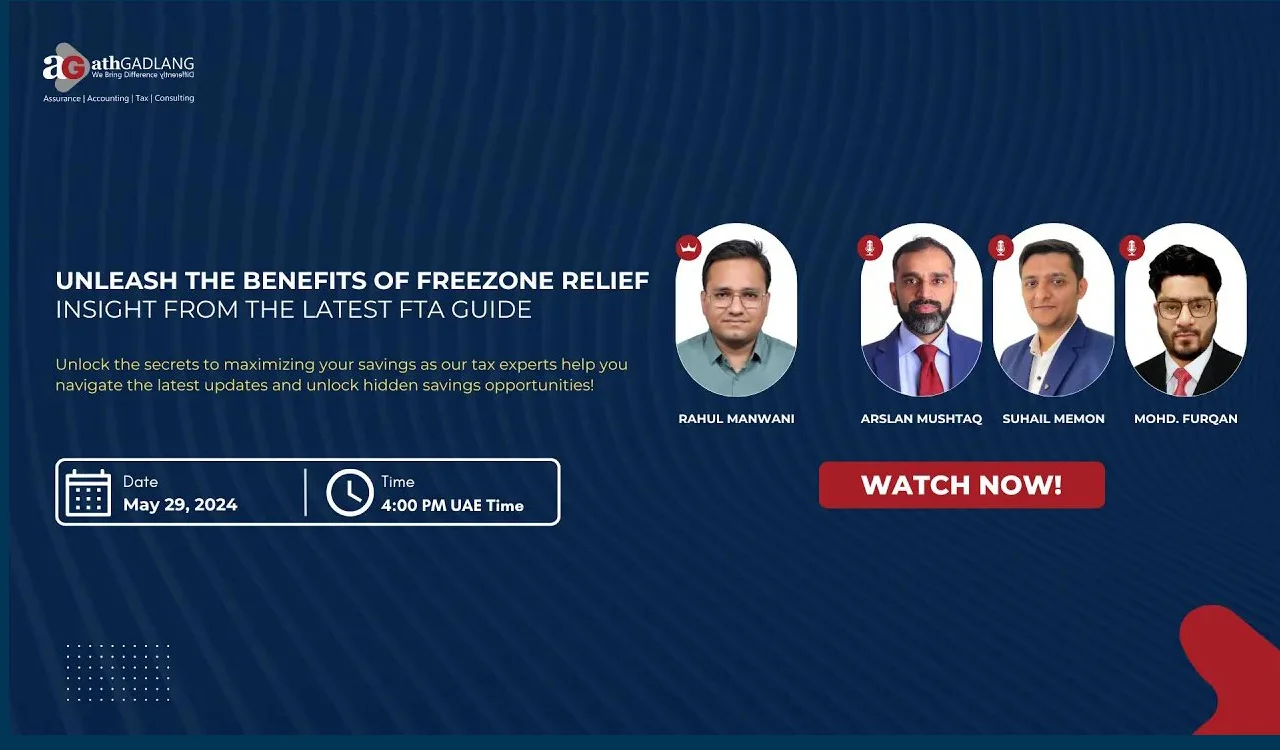

Webinars

Have a question or need expert guidance? We’re here to help.

Simply fill out the form, and we’ll get back to you with tailored solutions to meet your needs.

Your next business breakthrough starts here.